Difference between revisions of "Strategic Alliance Components"

NonprofitAM (Talk | contribs) (→Joint Ventures) |

NonprofitAM (Talk | contribs) (→Joint Ventures) |

||

| Line 80: | Line 80: | ||

Center for Association Leadership: [http://www.asaecenter.org/Resources/AMMagArticleDetail.cfm?ItemNumber=6382 Legal: Tax-Exempt and Commercial Organization Joint Ventures] | Center for Association Leadership: [http://www.asaecenter.org/Resources/AMMagArticleDetail.cfm?ItemNumber=6382 Legal: Tax-Exempt and Commercial Organization Joint Ventures] | ||

| + | |||

| + | Neo Law Group Nonprofit Law Blog - Nonprofit Joint Ventures [http://www.nonprofitlawblog.com/nonprofit_joint/] | ||

===Mergers=== | ===Mergers=== | ||

Revision as of 17:13, 2 November 2017

As nonprofits consider strategies for the future, it is not unusual for a board or staff to explore the possibility of collaborating or entering into strategic alliances with another nonprofit(s) or even a for-profit entity. Your nonprofit may actively seek out a collaboration, consider restructuring, or even consider a merger. Before plunging into a strategic alliance, it is helpful to be familiar with common pitfalls and challenges. [1]

Contents

Levels of Collaboration

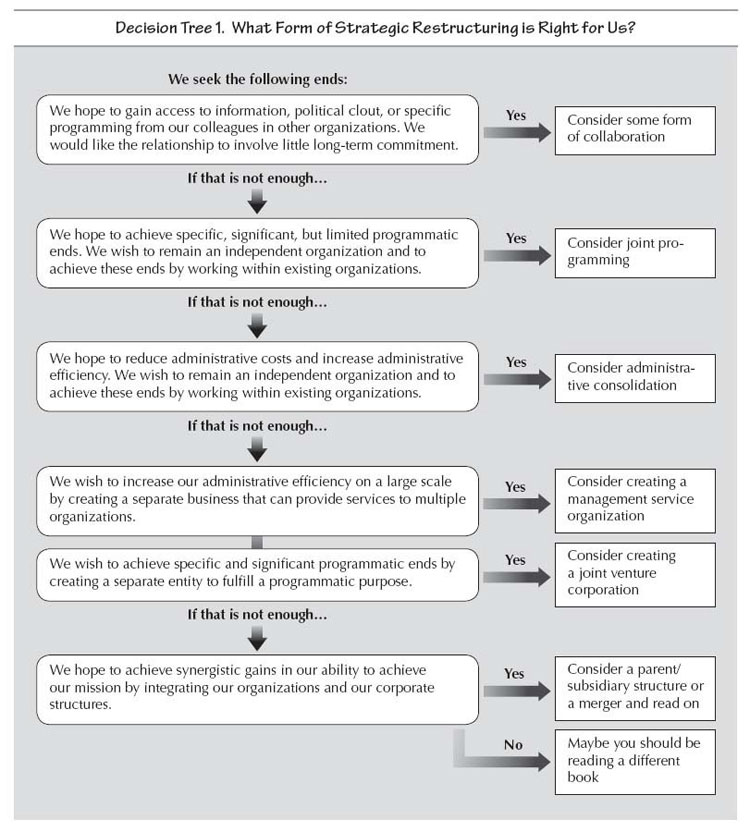

Collaboration Decision Tree

Fiscal Sponsorship

Fiscal sponsorship is a formal arrangement in which a 501(c)(3) public charity sponsors a project that may lack exempt status. This alternative to starting your own nonprofit allows you to seek grants and solicit tax-deductible donations under your sponsor's exempt status.[4]

Determining whether or not you need a sponsor is up to you. The decision rests on whether you as a grantseeker can make it on your own, whether you want to go it alone, whether your idea lends itself to development by just one individual, and whether support services are required. There are as many types of sponsors as there are ideas for grants. There are varying levels and degrees of affiliation with any given sponsor. The choices concerning what kind you need and how structured or loose the relationship should be are also up to you. The individual grantseeker can and should create a sponsoring arrangement that benefits him and his grant idea, while not losing sight of the motivation of the funder.[5]

The main reason that funders — foundations, corporations, and government agencies — hesitate to give directly to individuals is simple: it costs too much to do so. Reportedly, it takes as much administrative time and work to award a $5,000 grant to one individual as a $500,000 grant to a university. The obvious administrative strategy to keep down the cost is to give a lump sum to one outstanding group (a sponsor) whose function it is to "pass [grant monies] on down the line." A second reason that funders prefer affiliated applicants is that sponsors serve as a kind of buffer to dilute the funder's responsibility in case something goes wrong. [6]

Fiscal sponsorships should be memorialized in a written agreement between the fiscal sponsor and the sponsored organization. The agreement should specify that the fiscal sponsor is responsible for all legal compliance relating to receiving, reporting, and acknowledging charitable donations, and also describe the administrative fee that the sponsored organization will provide to its fiscal sponsor.[7]

Joint Ventures

A joint venture is a separate legal entity formed by two or more parties to undertake economic activity together. The separate entity may be purposefully created as a partnership, limited liability company or corporation (either for-profit or nonprofit).

Nonprofit organizations may engage in joint ventures with other organizations, whether nonprofit or for-profit, with certain limitations. The primary limitations for a charitable nonprofit: (1) the operation of the joint venture must be consistent with the charity's operation primarily for exempt (e.g., charitable and educational) purposes; and (2) the operation of the joint venture must not result in any prohibited private benefit. The law with respect to these limitations has evolved with several seminal cases and IRS revenue rulings.[8]

Types of Joint Ventures[9]

- Ancillary joint ventures involve a limited portion of the assets or services of an exempt organization.

- Whole joint ventures involve all or substantially all of the assets of an exempt organization.

- Exempt-only joint ventures involve the assets or services of two or more exempt organizations.

- Investment-type joint ventures involve the participation of an exempt organization in a limited or passive capacity.

Joint ventures between tax-exempt organizations and for-profit entities can lead to unfavorable tax implications for the exempt organization, including disqualification from tax exemption, if the venture is not structured in accordance with IRS rules and regulations. As a result of Ruling 2004-51, it appears that "control" of the entire venture is no longer essential. As such, tax-exempt organizations will now likely have the option of participating in bifurcated joint ventures without jeopardizing tax-exempt status, as long as the exempt organization controls the substantive, exemption-related aspects of the venture. However, notwithstanding the much-needed guidance, tax-exempt organizations should continue to proceed with caution when engaging in joint ventures, partnerships, or similar arrangements with commercial businesses.[10]

If your nonprofit is engaging in a joint venture or a partnership arrangement with another entity, it is up to the board to ensure that the nonprofit is not engaging in a transaction resulting in private benefit to the other partner. A policy is helpful to ensure there has been a review of the partnership or joint venture arrangement that might uncover, for example, one of the parties in the joint venture is a family member of a board member (conflict of interests) or that the payments being made to the non-charity partner are in excess of market value (excess benefit transaction).[11]

Memorandum of Understanding

An effective Memorandum of Understanding (MOU) prevents misunderstandings and disputes by clarifying the expectations of the partners. The process of developing an MOU is an instructive and potentially invaluable experience in partnering. You will learn how responsive your partner will be—are your calls returned promptly? Does your partner give the partnership the attention and seriousness it requires? You may also learn how your partner reacts when you disagree on an issue. In many cases, you will learn vital information such as:

- the corporate structure of your partner (don’t assume!)

- whether your partner has liability and other types of insurance

- what specifically the partner is willing to promise (ambitious projections may dissipate as your partner commits to something realistic)

- what aspects of the project your partner is willing to be responsible for

- how each organization will assess or evaluate the success of the project

- your partner‘s overall commitment to the project

The refusal to put anything in writing is a red flag and may be sufficient reason not to proceed with the arrangement.[12]

What to include in a Memorandum of Understanding: Drafting a Memorandum of Understanding (Nonprofit Risk Management Center)

Resources & Sample Documents

Collaboration General

Foundation Center: Nonprofit Collaboration Resources

Grantspace: Collaboration Best Practices Infographic

Fiscal Sponsorship

Foundation Center: Guide to Fiscal Sponsorship

Foundation Center: Sample Fiscal Sponsorship Policies & Documents

National Council of Nonprofits: Fiscal Sponsorship

National Council of Nonprofits: Fiscal Sponsorship Resources

Trust for Conservation Innovation: Fiscal Sponsorship: A 360 Degree Perspective

Joint Ventures

National Center on Nonprofit Enterprise: Joint Ventures

Center for Association Leadership: Legal: Tax-Exempt and Commercial Organization Joint Ventures

Neo Law Group Nonprofit Law Blog - Nonprofit Joint Ventures [1]

Mergers

Stanford Social Innovation: Merging Wisely

Compasspoint: The M Word: A Board Member's Guide to Mergers

Bridgespan: Mergers & Acquisitions: More Than A Tool for Tough Times

Neighborworks: The Making of the Nonprofit Merger

New York Times: Charities Trying Mergers to Improve Bottom Line

Notes

- ↑ http://www.councilofnonprofits.org/knowledge-center/resources-topic/administration-and-management/partnerships-and-collaboration

- ↑ http://www.fieldstonealliance.org/client/tools_you_can_use/11-15-07_when_to_merge.cfm

- ↑ http://www.fieldstonealliance.org/client/tools_you_can_use/11-15-07_when_to_merge.cfm

- ↑ http://www.grantspace.org/Tools/Knowledge-Base/Funding-Research/Definitions-and-Clarification/Fiscal-sponsorship>

- ↑ http://foundationcenter.org/getstarted/tutorials/fiscal/inst_aff.html

- ↑ http://foundationcenter.org/getstarted/tutorials/fiscal/inst_aff.html

- ↑ http://www.councilofnonprofits.org/fiscal-sponsorship

- ↑ http://www.nonprofitlawblog.com/home/2006/10/nonprofit_joint.html

- ↑ http://www.asaecenter.org/Resources/AMMagArticleDetail.cfm?ItemNumber=6382

- ↑ http://www.asaecenter.org/Resources/AMMagArticleDetail.cfm?ItemNumber=6382

- ↑ http://www.councilofnonprofits.org/resources/resources-topic/boards-governance/joint-ventures-and-partnerships

- ↑ http://www.nonprofitrisk.org/library/enews/2007/enews052307.htm